Indonesia’s G20: How Can Major Economies Solve Global Supply Chain Disruption?

JAKARTA, KOMPAS.com – The disruption of the global supply chain has been an important issue since the Covid-19 pandemic spread all over the world. The recent geopolitical issues between Russia and Ukraine have put yet more pressure on the production capacities which influences the supply of certain commodities.

Both are responsible for creating the bottlenecks of global shipping, especially containerized cargo.

The role of containership is very crucial in global trade. Around 60 percent of all seaborne trade used containers in 2019 with an estimated value of around $14 trillion, the UN Conference for Trade and Development (UNCTAD) said in a report.

The supply chain bottleneck that happens globally has piled up a huge volume of containers in several global ports. Moreover, the shortage of port labor, shipmen, truck driver, and other parts have worsened the capacity chains.

China-North America is the densest trading route in the world based on the UNCTAD database. In 2020, goods worth $457 billion were imported by the United States from China whereas goods worth $136 billion also traveled in the opposite direction.

Also read: Container Shortages Slow Down Indonesia’s Export of MSME Products

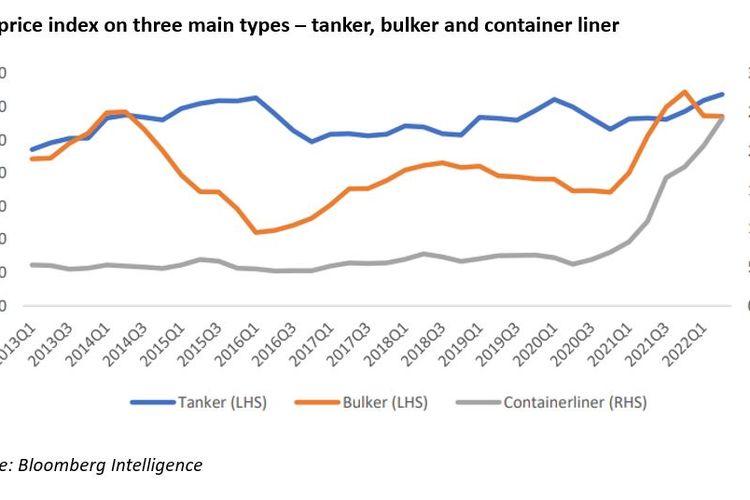

Bloomberg Intelligence data in April 2022 reported sharp increases in three major global trade routes: Asia-Asia, Asia-North America, and Asia-Europe. From April 2021 to April 2022, the freight rate index increased sharply from 165-145 on the Asia-North America route, 150-25 in intra-Asia trade, and 162-261 on the Asia-Europe route. At the same time, the volume of cargo is steady about 14-15 million Twenty Foot-Equivalent units (TEUs) per month.

The increase in freight rates triggers a further impact on macroeconomic variables such as inflation. The International Monetary Fund (IMF) estimates the impact of transportation costs on inflation based on data from 143 countries over the past 30 years. The results show that when freight rates double, inflation increases by about 0.7 percentage points.

To make things worse, the impact might last up to 18 months. Hence, the implication is quite worrying that if the observed freight rate happens in 2022, we might experience the impact on inflation in 2022.

A report by IFG Progress shows some elasticities in domestic freight rates due to pressure on the oil price. On a particular route connecting the Indonesian cities of Jakarta and Medan, a one percent increase in oil price drives up freight rates by 0.8 percent with a potential lagging impact in the upcoming periods.

The impact of rising shipping costs is not uniform among countries where structural characteristics play an important role. It means that countries with a greater degree of imports and those depending more on transportation such as island countries might experience a higher rate of inflation.

In Indonesia, the increase in logistic costs has been transmitted to overall headline inflation (Consumer Price Index) through import prices such as commodities. Another issue is that domestic fleets shift to the international route leaving the domestic trade left out with fewer fleets that vault up the cost of domestic costs.

Leading the presidency of G20 countries in 2022, Indonesia realizes that the disruption in the global supply chain can hinder the realization of a strong and inclusive recovery and hamper productivity. This problem needs a global agreement on the strengthening of logistics infrastructure that allows sufficient capacity and distribution of logistics infrastructure.

Possible solutions

For the G20 countries, there are two possible solutions to overcome the bottleneck. First, the skyrocketing freight rates happen because the global merchant containerized cargo is falling under an Oligopoly market structure. The value of the Gini ratio hikes up to 0.7607 in the 2000s vs. 0.5767 in the 1990s.