Getting Stronger: Indonesia's Recovery from Dutch Legacy of Severe Debt

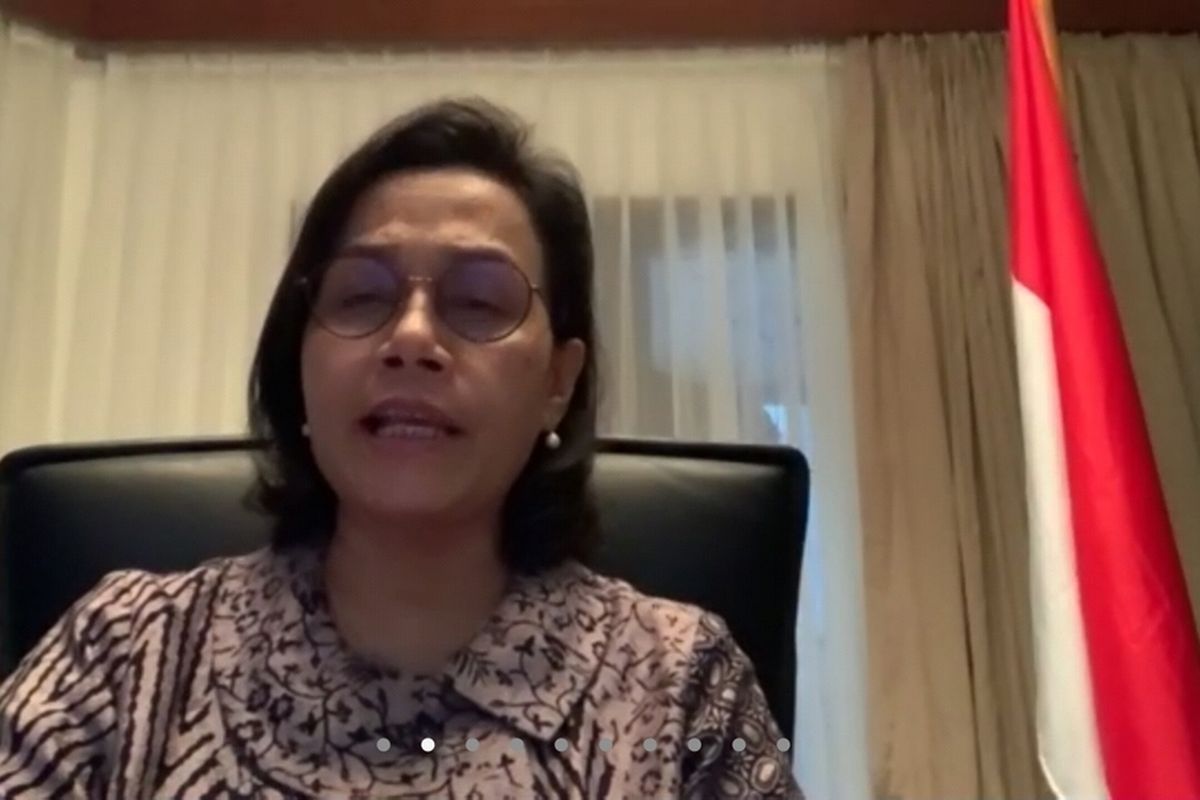

JAKARTA, KOMPAS.com – The Indonesian economy has made good progress since the country gained independence from Dutch rule in 1945, Indonesian Finance Minister Sri Mulyani said in a presentation that recalled the economic damage resulting from the massive colonial debt it inherited.

“From 1945 to 1949 Indonesia was still under intimidation, confrontation, and even Dutch military aggressions. The political, security and economic conditions were uncertain at the time,” Sri Mulyani said during her presentation at the opening of the Finance Professional Expo on October 12.

“The former colonial rule has left a legacy of not only a damaged economy but also their total debt,” she added.

Sri Mulyani went on to say that when Indonesia gained its independence, it did not have assets because the war damaged its property. The ‘frozen investments’ by the Dutch became Indonesian investments after it gained independence.

Also read: Finance Minister Expects Indonesian Economy to Grow 0.5 percent in Q3

“Their debt of $1.13 billion became the debt of the Indonesian government. At the time, Indonesia’s GDP was still very small,” she said.

It was reported previously that the total government debt as of the end of August 2020 stood at 5,594.93 trillion rupiahs ($379.76 billion), up 19.5 percent from the same period last year. The position of Indonesia’s debt ratio reached 34.53 percent of GDP.

The Indonesian economy was then also financed by a state budget deficit. The financing, however, at that time was not through the sale of sovereign debt papers (SBN) as it is today. It asked Bank Indonesia (BI) to print money.

Also read: Jokowi: Tackle Covid-19 Cases in 12 Indonesian Cities, Regencies

“When asking BI to print more money, what happened was it increased the amount of cash circulating in the economy, causing a rise in inflation,” she explained.

Furthermore, in the New Order era, all debts were spent on development. By the time the financial crisis hit Asian countries, Indonesia's current account deficit increased, putting pressure on the rupiah exchange rate.

“So when there was an adjustment in the exchange rate, the entire balance sheet of companies, banks, country, all experienced pressures because, within a day, the rupiah exchange rate changed suddenly, volatility increased, assets did not increase, companies with rupiah cash flow and foreign-denominated debt collapsed,” she said.

Sri Mulyani said currently Indonesia’s economic condition is getting stronger. The government also carried out financial reforms to tackle the Covid-19 pandemic.

Also read: Indonesia Expects Covid-19 Vaccine From Gavi Covax Facility By 2021

Amid the Covid-19 conditions this year, she said, the government has also prepared a budget for handling the Covid-19 for next year.