Indonesia Remains Strong amid Closure of Three US banks: Central Bank

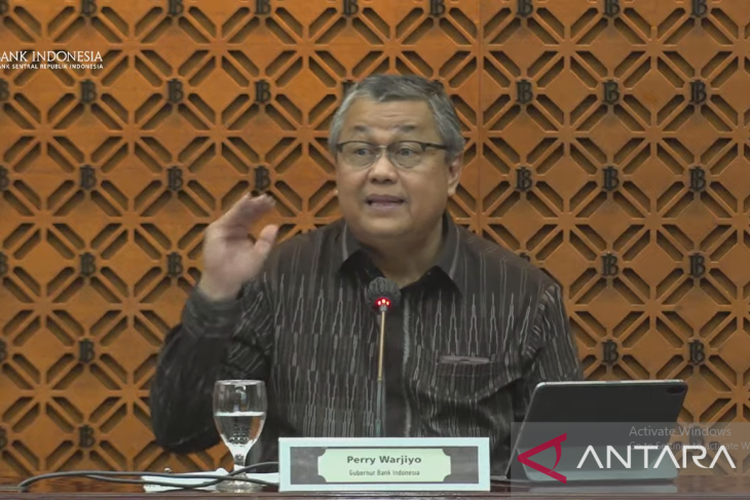

JAKARTA, KOMPAS.com - Indonesia's strong financial stability has left it unaffected by the closure of Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank in the United States, Governor of Bank Indonesia (BI) Perry Warjiyo said.

"The results of our stress test simulation conclude that Indonesia's financial system stability is resilient in facing this global turmoil, including the impact of the three banks," Warjiyo said during the announcement of the results of the BI Board of Governors' Meeting in March 2023, which was monitored online in Jakarta on Thursday, March 16.

Overall, the results of stress tests conducted by central bank show that the banking conditions in Indonesia are resilient to the impact of the closure of the three US banks.

Also read: Renewable Energy Transition Requires $3.5 Trillion in Investment Per Year: Bank Indonesia

Indonesia's strong financial stability is supported by diversified deposit funding, which strengthens funding resilience in Indonesian banks. Almost no banks in the country have US treasury bonds, so the direct impact is very limited.

"The risk of direct impact is almost zero. Most of our banks do not invest funds in these three banks. We are also not depositors of these three banks, so there is no direct impact," he said.

Furthermore, the capital adequacy ratio (CAR) of banks in Indonesia is also high, reaching 25.88 percent.

Another supporting factor is the ownership of Government Securities (SBN) that has undergone good risk management, namely the shift from available-for-sale (AFS) to hold-to-maturity (HTM). Meanwhile, for the valuation risk, there is already an allowance for impairment losses (CKPN).

Also read: Indonesia Inflation May Plunge to 1.5%-3.5% in 2024: Central Bank

However, Warjiyo said he needs to be aware of the impact of market and investor expectations or perceptions of the turmoil from the banks' fall. Hence, BI continues to manage this perception by stabilizing the rupiah exchange rate through intervention and coordination with stakeholders, including the Ministry of Finance.

"Stabilize the rupiah exchange rate to control imported inflation and mitigate the impact of global turmoil, and this is for monetary stability and stability of our financial system," he said.

BI strengthens the stabilization of the rupiah exchange rate as part of efforts to control inflation, especially imported inflation, through intervention in the foreign exchange market with spot transactions, Domestic Non-Deliverable Forwards (DNDF), as well as the buying and selling of Government Securities (SBN) in the secondary market.

BI also continues the twist operation through the sale of SBN in the secondary market for short tenors to increase the attractiveness of SBN yields, especially for foreign portfolio investors, to strengthen the stability of the rupiah exchange rate.

Source: State News Antara

Simak breaking news dan berita pilihan kami langsung di ponselmu. Pilih saluran andalanmu akses berita Kompas.com WhatsApp Channel : https://www.whatsapp.com/channel/0029VaFPbedBPzjZrk13HO3D. Pastikan kamu sudah install aplikasi WhatsApp ya.